Many small business owners have had a lot thrown at them over the past few years. But despite rising inflation, supply chain issues, and other pandemic-era economic uncertainties, the Small Business Index actually hit its highest score in recent years at 66.8. So what are some of the tactics small businesses are implementing to continue growing their business’s health, and what are some of the possible hurdles your business could still face in the coming months?

Creating A Healthy Business Plan in An Unhealthy Economy

Possibly the toughest thing many of these businesses are facing is that despite seeing their businesses stabilize, nearly 70% of small business owners still stated a drop in the quality of their local economies. That’s why many current successful small business owners have been revisiting their business plans. Whether they’ve downsized, taken on more work themselves, or better targeted their demographics to decrease overhead, these creative adjustments are contributing greatly to the success of small businesses.

New Work Environments

Another major issue facing most small businesses has been the ongoing hiring shortage. As mentioned above, many owners have seen themselves taking on more tasks and hats than in previous years to combat their lack of manpower. Though for small businesses willing to compromise, hybrid work situations have been a promising solution, making their hiring process more competitive and alluring to potential employees.

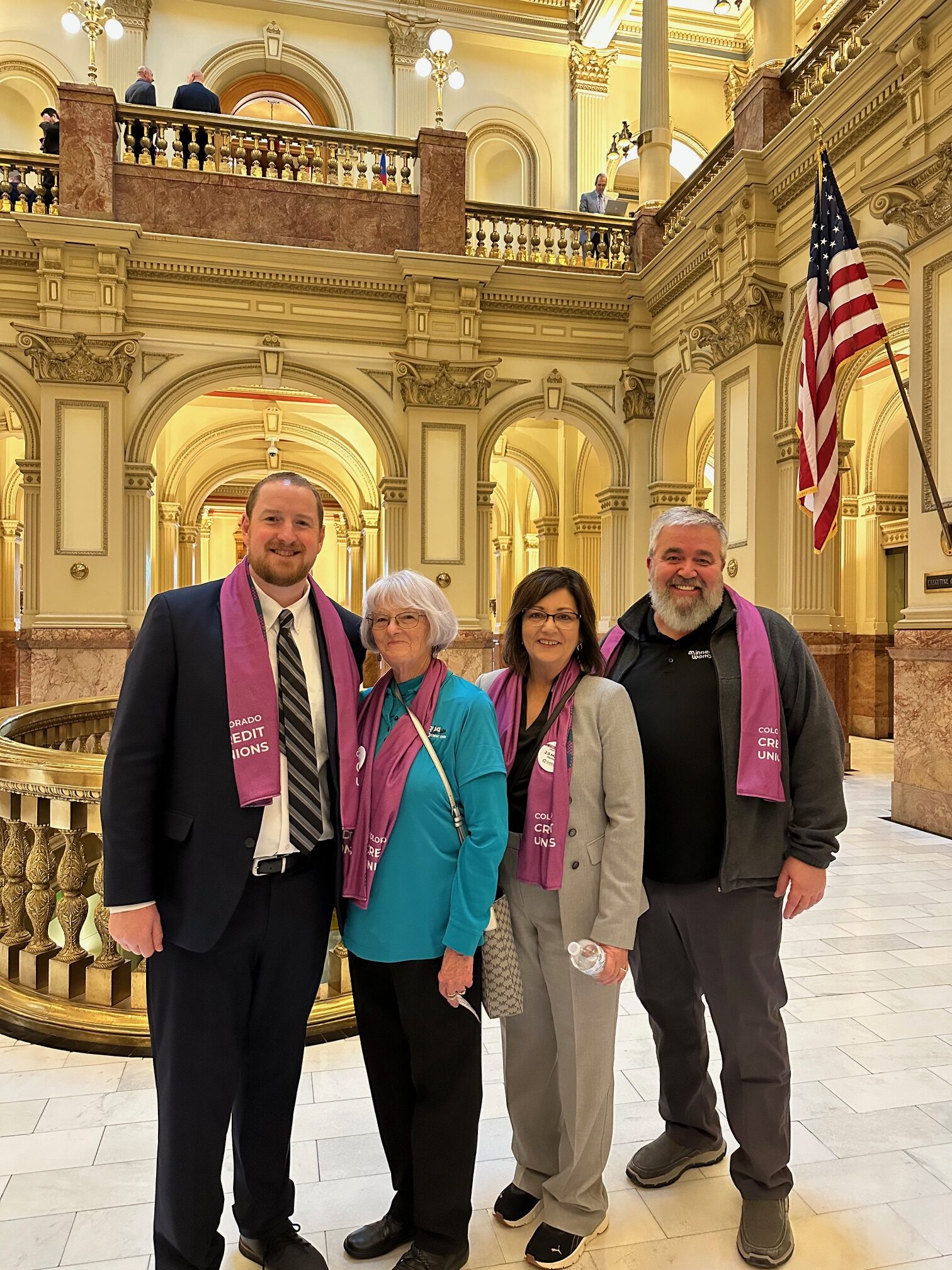

Countering Inflation With Low Rate Loans

To combat increasing inflation, many of these businesses have been raising prices, and again downsizing. Credit unions have also been a cornerstone for many small business owners, with 46% saying they have taken out loans to assist with raising supply costs, meaning that low-rate business loan options from credit unions are one of the best tools in the inflation fight for many business owners.

Sources: https://www.cutoday.info/Fresh-Today/What-do-Small-Business-Owners-Say-is-Big-Challenge-It-s-Not-Hard-to-Guess