When it comes to financial institutions, Credit Unions and Banks stand out as two distinct entities, each offering unique advantages and approaches to serving their customers. While both provide financial services, the fundamental differences lie in their structures, ownership models, and overall missions.

Ownership and Structure:

Credit Unions are member-owned, not-for-profit financial cooperatives. Members are not customers but rather owners who share a common bond, such as employment, community, or affiliation. This ownership model allows Credit Unions to prioritize member interests, focusing on providing competitive rates, lower fees, and personalized services.

Banks, on the other hand, operate as for-profit institutions owned by shareholders or stakeholders. Their primary objective is to maximize profits for their shareholders, often resulting in higher fees and fewer member-centric benefits compared to Credit Unions.

Community Involvement and Impact:

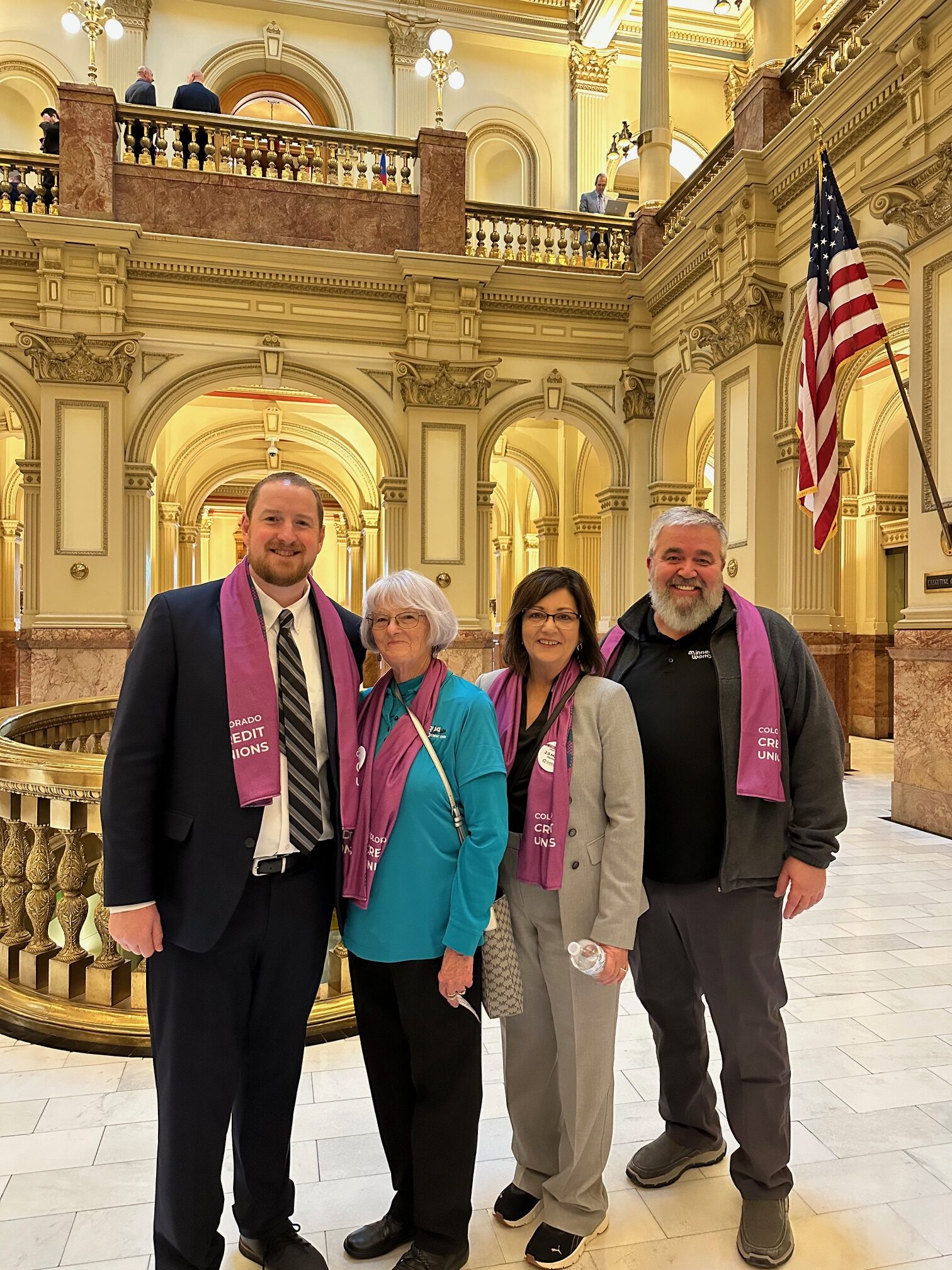

One significant advantage of Credit Unions is their deep-rooted commitment to community involvement and support. Minnequa Works Credit Union, for example, takes immense pride in actively engaging and reinvesting in the community of Southern Colorado. Through various initiatives like volunteer programs, financial education seminars, and partnerships with local organizations, Credit Unions like Minnequa Works contribute significantly to the social and economic well-being of the communities they serve.

Reinvestment in Members:

Unlike Banks, Credit Unions operate with a “people-first” philosophy. As not-for-profit organizations, their earnings are reinvested back into the institution and their members. This often translates to higher interest rates on savings accounts, lower loan rates, and fewer fees compared to traditional banks. At Minnequa Works Credit Union, the primary goal is to benefit the members directly, offering competitive financial products while prioritizing their financial well-being.

Minnequa Works Credit Union’s Impact in Southern Colorado:

Minnequa Works is more than just a financial institution; it’s a pillar of support and service within the Southern Colorado community. By fostering financial literacy programs, supporting local businesses, and empowering members to achieve their financial goals, Minnequa Works Credit Union plays an integral role in building a stronger and more prosperous community.

The difference between a Credit Union and a Bank goes beyond financial services; it’s about the fundamental philosophy and values that drive their operations. Credit Unions like Minnequa Works focus on the betterment of their members and the communities they serve, embodying the spirit of cooperation, empowerment, and service.

Credit Unions stand out as member-driven institutions dedicated to enhancing financial well-being and community prosperity. Minnequa Works Credit Union continues to make a significant impact in Southern Colorado by staying true to its mission of serving members and the community with dedication and integrity.

At Minnequa Works Credit Union, your financial success is our top priority. Contact Us to Learn More